Think Payments,

Think AXS

25 years of making bill payments easier for consumers and organisations.

$300+ Billion

total payments value processed

800+

businesses supported with payments

700+ Million

transactions processed

Dedicated to making payments easier

We know payments isn't easy. That’s why we’ve been making bill payments easier for our users since 2000.

Built in Singapore, made for Asia

We're setting our sights to become a regional payment solutions provider.

Milestones

Milestones

January 2025

- Hello world!

Brand New AXS

January 2024

- Partnering with TripleA, AXS App users can now makepayment using digital currencies such as Bitcoin (BTC), Ethereum (ETH), USD Coin (USDC), and Tether (USDT).

February 2024

- To address gaps created due to bans of remittance houses in China, AXS partnered with Aleta planet to provide remittance services was enabled for users on the AXS app via the UnionPay International Network.

August 2024

- AXS Drive App was launched, allowing users to pay for parking, EV charging, road tax and more. It aims to be the AlO motorist app for drivers, simplifying the driving experience for motorists.

September 2024

- Mainland Chinese residents can now pay for bills in Singapore on the UnionPay App via AXS channels.

Acquisition

In 2023, Tower Capital Asia became the largest shareholder of AXS. With the support of Tower Capital Asia, AXS will continue to strengthen and expand its products and service offerings in existing and new business segments and markets.

Innovation

Continuing its commitment to innovation, AXS introduced new functions and features to its platform, staying ahead in the dynamic landscape of payment technologies. This includes:

- Bills reminder – a function on AXS m-Station to assist user in making timely regular payments.

- MyVehicle – service to alert motorist on any outstanding fines.

- Pay Any Bills – for payment of bills to organizations not listed in the regular list of billers.

- Tokenized payment – in partnership with Mastercard to achieve frictionless payment for Mastercard credit card and debit card holders.

- Embedded insurance – through a partnership with Chubb, micro insurance coverage was made available to AXS users.

- AXS Selection – a portal where AXS brings to our users a selection of financial offerings from credit card providers, bank loans, insurance telco offerings, etc.

AXS further consolidates its position as the leading bill payment processor by empowering bills payment services for 12 financial institutions on their mobile app and internet site – achieving greater efficiency and cost savings for the FIs through a “One-to-Multiple” linkage.

Greater payment choice

Leveraging improvements in digital payment capabilities, AXS underwent a significant transformation by refreshing the interface of AXS m-Station and optimizing its platforms for seamless online transactions. AXS boasts the acceptance of new payment modes such as DBS PayLah! Express and Masterpass for the convenience of our users.

Upgrades

By 2014, all AXS Stations have been upgraded with new look and enhanced security features. The 900th AXS Station was also deployed in Singapore, while AXS m-Station achieved a milestone with over 500,000 application downloads.

Digital Initiatives

Embracing the digital age, 2013 marked the launch of new AXS payment channels - AXS e-Station (web) and AXS m-Station (mobile app). In the month of it’s official launch, AXS m-Station reached a total download of over 200,000 for iOS and Android platforms.

Anniversary

In 2010, AXS celebrated its 10th anniversary with the deployment of the 700th AXS Station in Singapore, broadening its reach and enhancing accessibility for customers across various locations.

Acquisition

DBS Bank acquired AXS as a subsidiary, becoming the company’s largest shareholder.

Growth

2003 marked the year that AXS saw a monthly transaction processing value of $50 million. A newer and sleeker version of AXS Station was also introduced, followed by an upgraded version, the Twin Station in 2005.

Service Expansion

By 2002, AXS had processed more than $10 million worth of transactions per month and successfully expanded its core offering to include government e-services, broadening its reach and enhancing accessibility for customers across various locations.

Product Launch

AXS introduced its pioneering electronic payment services via the AXS Station, offering convenient bill payment options to the public.

Establishment

AXS Pte Ltd was founded in the year 2000, marking the beginning of its journey as a bill payment aggregator.

2025

2024

2023

2018-2022

2015-2017

2014

2013

2010

2006

2003-2005

2002

2001

2000

Our management

Jeffrey Goh

Group CEO & Executive Director

Jeffrey can be considered one of the pioneers of Singapore's Fintech Industry, founding Singapore's first wireless payment gateway in the 1990s.

He was also one of the co-founders of AXS, growing it into a household brand synonymous with bill and fine payments.

Over the years, he has garnered a myriad of experiences managing and transforming fintech companies such as NETS and Grab. He now returns to AXS as the Group CEO, to push it beyond more than just a bill payments platform but to become a player in the payments industry in Southeast Asia (SEA).

Quah Chun Han

CEO, AXS Payments and Services

A pillar of the Finance and Fintech industries, Chun Han has crafted impactful financial and growth strategies for leading institutions like American Express, DBS, Citi, and UOB. Utilizing his deep banking expertise, he played a pivotal role in transforming Grab's payment platform into a dominant force across Southeast Asia.

Now, he joins AXS as a trailblazer, sharing our ambitious vision to become the premier payment powerhouse in Southeast Asia. His proven track record and keen insights will be instrumental in propelling us towards this exciting new chapter.

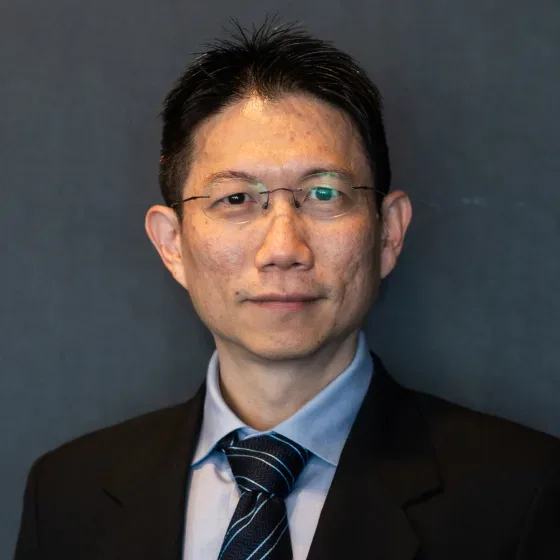

Koh Tze Wei

CTO, Tech

A seasoned architect of payment technology and platforms, Tze Wei has over 25 years of experience designing and implementing complex payment systems used by industry giants today. His specialization in payment infrastructure, architecture, and implementation makes him an invaluable asset as AXS's CTO.

With his deep expertise and forward-thinking vision, Tze Wei is instrumental in driving AXS beyond its current success, aiming to establish it as a key player in the Southeast Asian payments and FinTech industry.

Eugene Chan

Principal Advisor

Co-founder and Tech Architect of AXS since 2000, Eugene is a seasoned veteran in transactional and multimedia technology. He began his career at IBM and in 1996, co-founded AceNET Communications, a company specializing in point-of-sales and electronic fund transfer terminals.

With his deep knowledge of AXS's operations in the fintech space, he now serves as our Principal Advisor, providing invaluable guidance and clarity in ambiguous situations.

Candy Chng

CPO, Chief People Officer

Candy is a visionary HR leader with extensive expertise in Financial Services and Technology, known for designing and implementing people strategies that drive business success. With a career spanning global enterprises and hyper growth start-ups across Asia, she has a proven track record of leading HR transformations that elevate talent, foster organizational agility, and cultivate strong leadership capabilities.

At AXS, Candy is passionate about building a people-centric culture—one that empowers teams, sparks innovation, and accelerates growth. Her strategic mindset and deep HR acumen will play a pivotal role in shaping AXS’s journey as it expands across Southeast Asia, ensuring that its greatest asset, its people, continues to thrive.

Laverne Soh

CSO, Chief Strategy & Product Officer

A seasoned leader with over 25 years of experience in product management and strategy, Laverne has a proven track record of driving digital innovation, business integration, and growth across highly regulated industries. She has held strategic roles at Synapxe, Accenture, NETS, and Korvac, where she spearheaded the launch of transformative API ecosystems and was instrumental in pioneering next generation ePayment solutions that reshaped Singapore’s digital finance landscape.

As the Chief Strategy Officer at AXS, Laverne drives the strategic direction and regional expansion of the company’s digital platforms, leading the development of innovative ePayment solutions that position AXS at the forefront of the digital finance landscape.

Board of directors

Danny Koh

Chairman

Danny has over 20 years of private equity experience in Southeast Asia and has invested and originated over US$1b of transactions. He began his private equity career with 3i where he invested in and exited several successful deals. Before he founded Tower Capital Asia in 2016, he led the Southeast Asia private equity team at Actis.

Danny has a Bachelor of Accountancy from Nanyang Technological University, Singapore. Besides being on the boards of portfolio companies, he sits on the Services Committee of the National Council of Social Service, Singapore and is Vice Chairman of Community Chest, Singapore.

View more >

Seth Lim

Non-Executive Director

Seth joined Tower Capital Asia in 2020. He was previously an Investment Manager at ADM Capital, a private credit lender based in Hong Kong. Prior to this, Seth was a Research Analyst at Brightline Capital based in Greenwich, Connecticut. Seth started his career with Goldman Sachs in New York.

Seth received a Bachelor of Arts in Economics from the New York University, where he graduated magna cum laude.

John Thomson

Non-Executive Director

John has over 25 years of private equity investment experience. He started his career as a graduate trainee with Coats Viyella, a global textile manufacturer. In 1996, he joined 3i initially in the UK, and then moved to Singapore in 2000 where he was responsible for the group’s Southeast Asia private equity business. During this time, he has led both minority and control deals in a range of industries from across Asia, including China, India and Southeast Asia.

John holds a Bachelor of Science in Physiology and Sports Science from Glasgow University.

Jeffrey Goh

Group CEO & Executive Director

Jeffrey can be considered one of the pioneers of Singapore's Fintech Industry, founding Singapore's first wireless payment gateway in the 1990s.

He was also one of the co-founders of AXS, growing it into a household brand synonymous with bill and fine payments.

Over the years, he has garnered a myriad of experiences managing and transforming fintech companies such as NETS and Grab. He now returns to AXS as the Group CEO, to push it beyond more than just a bill payments platform but to become a player in the payments industry in Southeast Asia (SEA).