from 1.08% p.a.

+ 2% Cashback

Personal loan for every life milestone

Fast Approval

Easy application.

Flexible repayments.

Instant cash1

Cash is disbursed to your bank account of choice

Low interest rate

As low as 1.08% p.a.

(from EIR 2.09%) 2

Instalments loan repayment calculator

Estimate your monthly repayment by selecting your preferred loan amount and loan term.

S$

60 months

1.6% p.a (EIR 3.07%), no fees apply

Limited-time only

Enjoy 2% cashback of your approved loan amount

Valid now till 28 February 2026

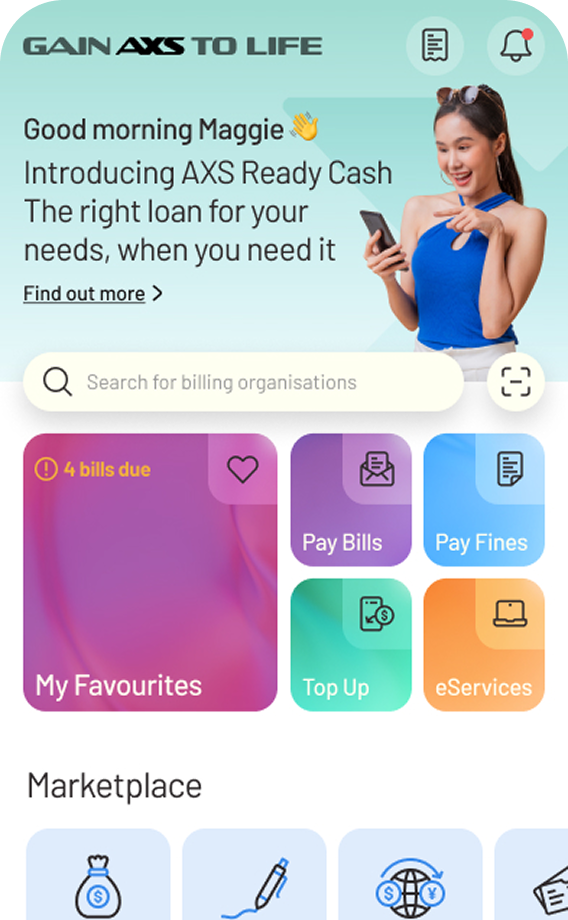

Sign up now in 4 simple steps

Step 1:

Select AXS Ready Cash

- Open the AXS app and tap on “AXS Loan” from the main menu.

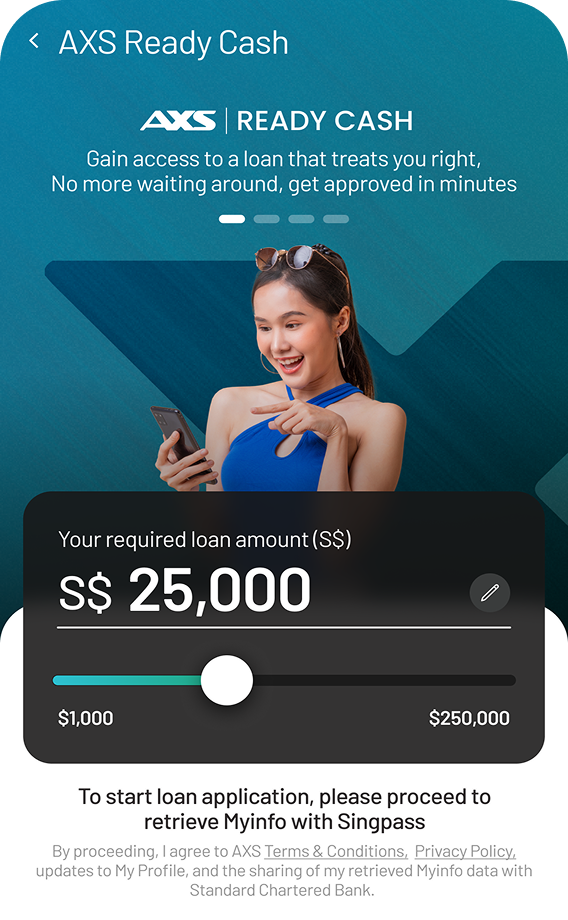

Step 2:

Choose your loan details

- Select the loan amount and repayment period based on your needs.

Step 3:

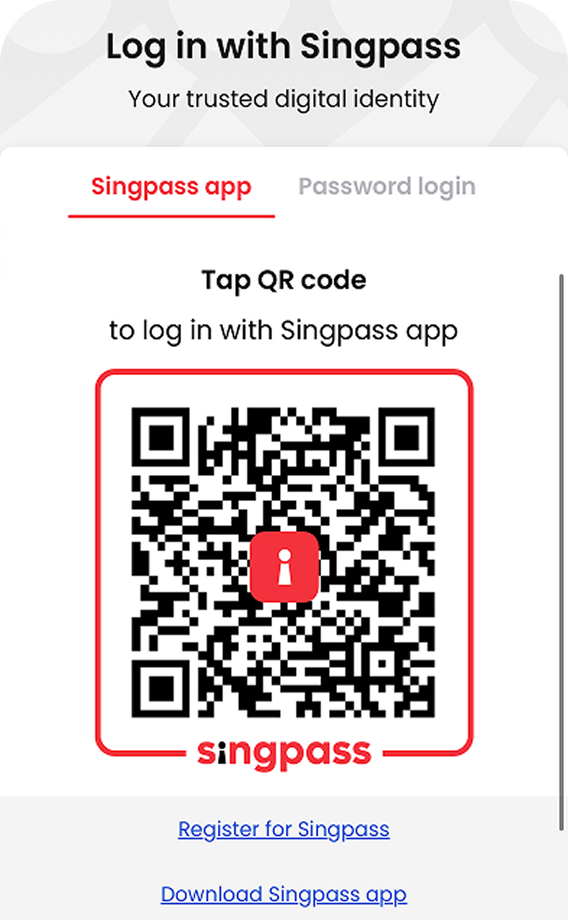

Log in & complete your application

- Log in securely using Singpass.

- Fill in the required details and submit your application.

Step 4:

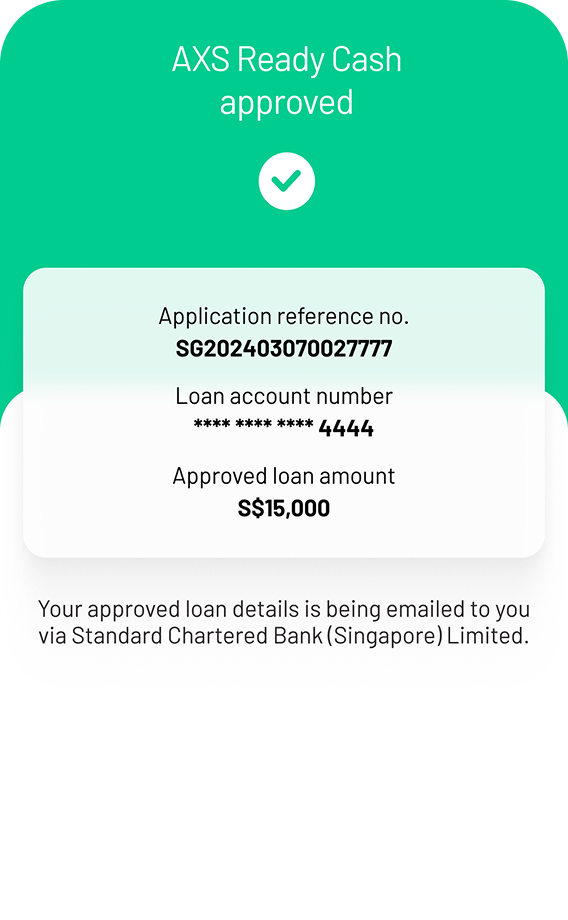

Get approved & receive funds

- Once approved, the loan will be disbursed to your bank account in 15 minutes2, and you’re all set!

Use AXS Ready Cash for

Frequently asked questions

-

AXS Ready Cash is a digital loan service underwritten by Standard Chartered Bank (Singapore) Limited (SCB) available on AXS m-Station, allowing eligible users to apply for and receive personal loans conveniently. The loan application process is seamless, with competitive interest rates and flexible repayment options.

-

Eligibility criteria include:

- Singaporean, Permanent Resident, or eligible foreigner with a valid work pass

- Aged between 21 and 60 years of age

- Minimum annual income as required by SCB

- A valid bank account in Singapore

-

You can apply for a loan through the AXS m-Station by following these steps:

- Open the AXS m-Station, go to Marketplace section and tap on AXS Ready Cash.

- Explore your preferred loan amount and loan tenure using the calculator.

- Proceed with loan application with Singpass Myinfo login.

- Verify retrieved information and fill in additional required details.

- Submit application for review.

- Receive confirmation and disbursement details upon approval.

-

Apply with Myinfo and you could enjoy instant approval, subject to no documentation review or further document requirements.

-

Once approved, the loan amount will be disbursed directly into your designated bank account by SCB.

- The transfer of funds is subject to approval of the application which must satisfy the Bank’s eligibility criteria. Terms and Conditions apply.

Effective Interest Rate (EIR) calculation based on a 5-year tenure. The calculation is not yet inclusive of the first-year annual fee of S$199. Taking into consideration the first-year annual fee of S$199, the EIR will be 2.49% p.a. for an average loan amount of S$20,000 at a 5-year tenure. The applied interest rate of 1.08% p.a. is our lowest rate. The interest rate offered to you in your application will be based on your credit profile as determined by Standard Chartered Bank (Singapore) Limited.

Terms and Conditions

AXS Ready Cash Product

AXS Ready Cash Exclusive Cashback Promotion