AXS Services Solutions

Empower your business with AXS

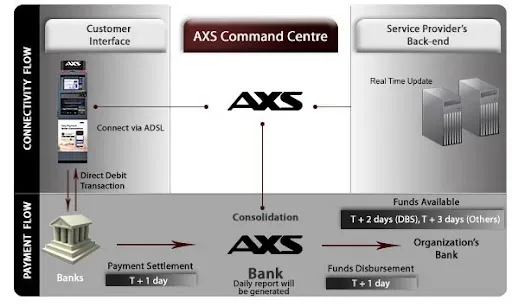

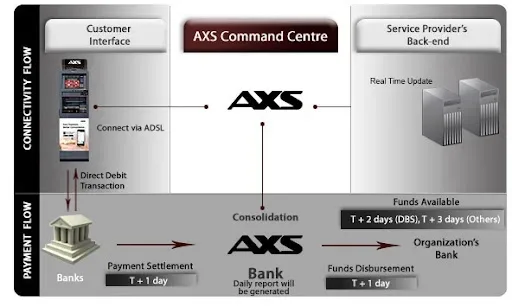

We provide solutions for billing organisations, channel partners and platform organisations to connect with end consumers for bill collection and other transactions across our channels.

Billing Organisations

Use AXS to offer secure bill payments or increase brand prominence through targeted promotions.

Service Providers

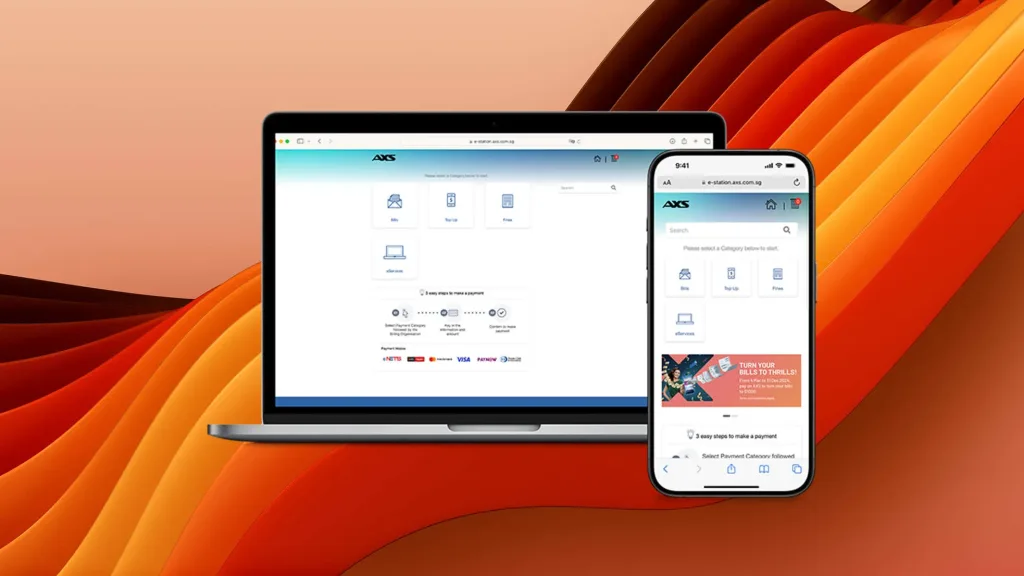

Reach more customers and offer convenient bill payments through our secure network - AXS Stations, AXS e-Station and AXS m-Station.

We handle everything, from collection to reporting, so you can focus on your business. Ideal for banks, government agencies, utilities, and SMEs.

eTenants Partners

Be an eTenant Provider and leverage the extensive network of AXS Stations to conduct promotions and boost brand prominence. Engaging electronic mechanisms like lucky draws, instant giveaways, and e-vouchers maximise the promotional appeal and effectiveness.

With over 650 AXS Stations and robust marketing communications, gain widespread exposure for your business and resonate with a broader audience through our platform.

Digital Fintech Partners

Streamline business payouts and transactions through AXS. Scalable with flexible integration options.

AXS wSDK

Access a comprehensive suite of bill payments, fines, and telco top-ups through our bill payment engine, designed to integrate within your ecosystem. Our versatile platform offers flexible integration options - AXS wSDK webpage linking, real-time API integration, or batch file processing.

Scalable to accommodate growing transaction volumes while ensuring high performance and reliability, our platform is backed by years of experience and trusted by leading businesses.

AXS Receive

AXS Receive, a new platform on AXS m-Station, streamlines fund crediting and e-Statement delivery for corporate refunds, claims, and payouts. It offers an efficient solution, benefiting businesses and customers alike.

For businesses, it eliminates cash/cheque handling, enables cost savings, improves customer engagement, and provides consolidated reporting. Customers enjoy a consolidated view of credit postings, e-Statements, transaction history, faster fund access, and a simplified digital experience for receiving funds and data.

Find out how our solutions can help your business

For more information on our solutions, please send us a message.