Our Story

What made us AXS

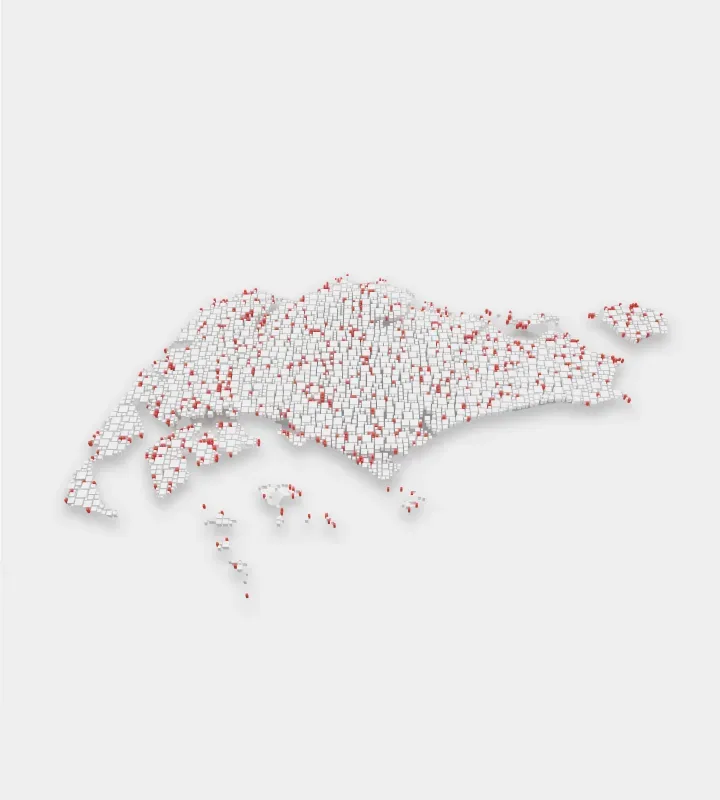

A remarkable 23-year track record in catering to the bill payment needs of both consumers and organisations on a multi-channel ubiquitous platform.

AXS Pte Ltd. was founded in year 2000 on the notion of bridging the digital barrier between consumers and business organisations.

With a remarkable 23-year track record in catering to the bill payment needs of both consumers and organisations on a multi-channel ubiquitous platform, AXS has emerged as the foremost payment solutions provider in Singapore.

To date, we have processed over 650 million bills with total payment value exceeding $210 billion for Singapore residents. Over one million consumers every month continues to access AXS's extensive range of over 600 bill payment services through our network of kiosks, mobile app and Internet portal.

With a strong foothold in Singapore's digital payments industry, AXS's next step is to transform into a regional cloud-based payment solutions provider. AXS plans to not only deliver a more powerful and seamless payment experience to organisations and consumers regionally, but also strengthen and innovate existing business operations, creating more value for all AXS’s consumers and organisations.

Here at AXS, we believe that life is short and should be spent on what matters. Which is why AXS is going beyond bill payment to bill management services for our users. Providing an efficient, effortless and safe payment experience, AXS aims to give our users access to all that life has to offer, uninterrupted.

Our Management

Our Management

Jeffrey Goh

Group CEO & Executive Director

Jeffrey can be considered one of the pioneers of Singapore's Fintech Industry, founding Singapore's first wireless payment gateway in the 1990s.

He was also one of the co-founders of AXS, growing it into a household brand synonymous with bill and fine payments.

Over the years, he has garnered a myriad of experiences managing and transforming fintech companies such as NETS and Grab. He now returns to AXS as the Group CEO, to push it beyond more than just a bill payments platform but to become a player in the payments industry in Southeast Asia (SEA).

Quah Chun Han

CEO, AXS Payment and Services

A pillar of the Finance and Fintech industries, Chun Han has crafted impactful financial and growth strategies for leading institutions like American Express, DBS, Citi, and UOB. Utilizing his deep banking expertise, he played a pivotal role in transforming Grab's payment platform into a dominant force across Southeast Asia.

Now, he joins AXS as a trailblazer, sharing our ambitious vision to become the premier payment powerhouse in Southeast Asia. His proven track record and keen insights will be instrumental in propelling us towards this exciting new chapter.

Koh Tze Wei

CTO, Tech

A seasoned architect of payment technology and platforms, Tze Wei has over 25 years of experience designing and implementing complex payment systems used by industry giants today. His specialization in payment infrastructure, architecture, and implementation makes him an invaluable asset as AXS's CTO.

With his deep expertise and forward-thinking vision, Tze Wei is instrumental in driving AXS beyond its current success, aiming to establish it as a key player in the Southeast Asian payments and FinTech industry.

Eugene Chan

Principal Advisor

Co-founder and Tech Architect of AXS since 2000, Eugene is a seasoned veteran in transactional and multimedia technology. He began his career at IBM and in 1996, co-founded AceNET Communications, a company specializing in point-of-sales and electronic fund transfer terminals.

With his deep knowledge of AXS's operations in the fintech space, he now serves as our Principal Advisor, providing invaluable guidance and clarity in ambiguous situations.

Board of Directors

Danny Koh

Chairman

Danny has over 20 years of private equity experience in Southeast Asia and has invested and originated over US$1b of transactions. He began his private equity career with 3i where he invested in and exited several successful deals. Before he founded Tower Capital Asia in 2016, he led the Southeast Asia private equity team at Actis.

Danny has a Bachelor of Accountancy from Nanyang Technological University, Singapore. Besides being on the boards of portfolio companies, he sits on the Services Committee of the National Council of Social Service, Singapore and is Vice Chairman of Community Chest, Singapore.

View more >

Soh Xuan Yong

Non-Executive Director

Xuan Yong has over 15 years of private equity and credit investment experience. Before joining Tower Capital Asia in 2018, he was Investment Director at ICG, where he led deals across Asia Pacific. Prior to this, he was with 3i and global hedge funds based in Hong Kong, New York and Singapore. Xuan Yong began his career at Merrill Lynch in investment banking.

Xuan Yong has a Bachelor of Arts (Distinction) from Cornell University with a triple major in Computer Science, Economics and Independent Major (College Scholar Program). He also holds CFA and FRM charters. Besides being on the boards of portfolio companies, he sits on the Professional Development committee of the Singapore Venture & Private Equity Association (SVCA).

View more >

Joey Chang

Non-Executive Vice Chairman

Our founder and business architect of AXS, with a true flair for entrepreneurship, played a pivotal role in shaping it into the household bill payments brand it is today. His vision was indispensable during his nearly 25 years as CEO.

Now, he takes on the role of Non-Executive, Vice Chairman. His expertise and experiences will continue to be invaluable. As we navigate this shift in company direction, his ability to offer a critical, third-party perspective will be crucial in tackling the challenges ahead.

Yazad Cooper

Non-Executive Director

Yazad Cooper is currently the Chief Financial Officer and Head of Strategy for the Consumer Banking and Wealth Management Group (CBG) since June 2020. Prior to his current appointment, Yazad was Group Head of Financial Planning and Analytics and Head of Business Finance for all Support Functions since 2013.

Yazad has been with DBS for the last 20 years and began his career with DBS Bank India in 2004 as its Chief Financial Officer. He was part of the core team entrusted with growing the franchise in India, increasing the bank's business, branch footprint and product offerings.

Prior to DBS, Yazad has donned key leadership and strategic responsibilities with KPMG, Deutsche Bank and HSBC.

Jeffrey Goh

Group CEO & Executive Director

Jeffrey can be considered one of the pioneers of Singapore's Fintech Industry, founding Singapore's first wireless payment gateway in the 1990s.

He was also one of the co-founders of AXS, growing it into a household brand synonymous with bill and fine payments.

Over the years, he has garnered a myriad of experiences managing and transforming fintech companies such as NETS and Grab. He now returns to AXS as the Group CEO, to push it beyond more than just a bill payments platform but to become a player in the payments industry in Southeast Asia (SEA).

Board of Directors

Milestones